Income and expenses might vary month by month. Is it really better? Is it user-friendly? If so, make the switch slowly. If you want to try a new app or method, consider what sets it apart from what you’re doing now.

If you’re a longtime user of an app or method, you have an established history that you can use to inform your decisions. While it might be tempting to go with a new method, it’s best to stick with what works for you. Avoid Fadsįinancial gurus are constantly offering what seems like new and exciting budgeting advice. Check user reviews and forums to see what might work best and what’s reliable. You can also look at the many budgeting apps out there. Many banks offer tools to automate recurring payments and analyze your spending.

Make Your Money Work for You Use Tools and Budgeting Apps

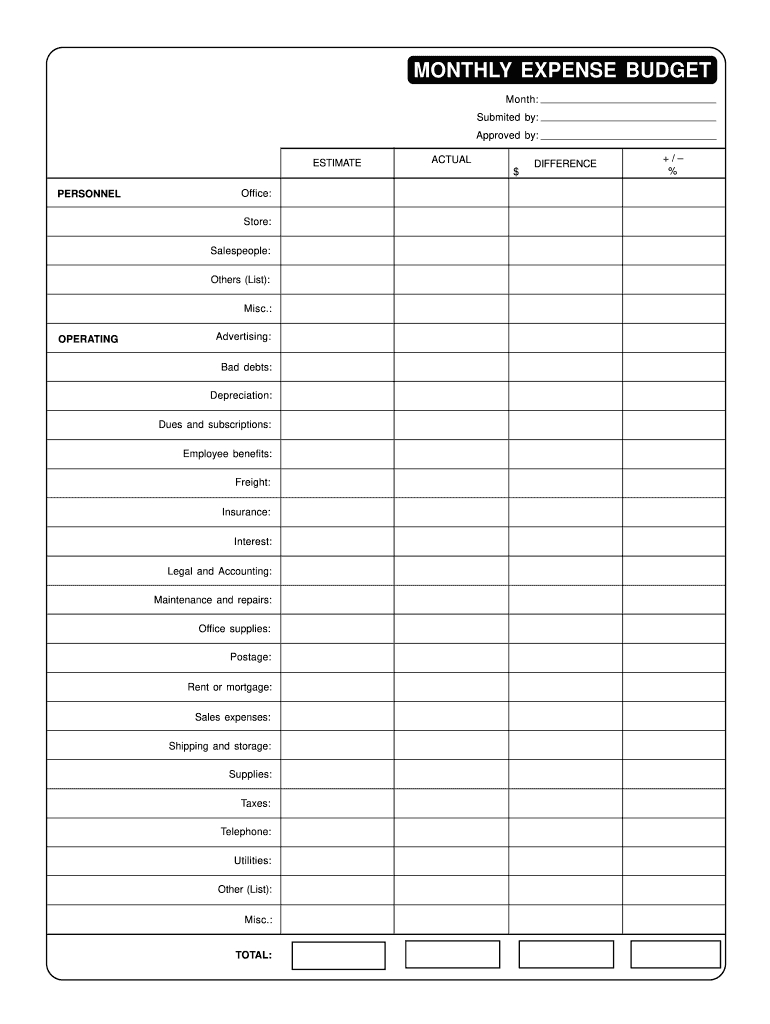

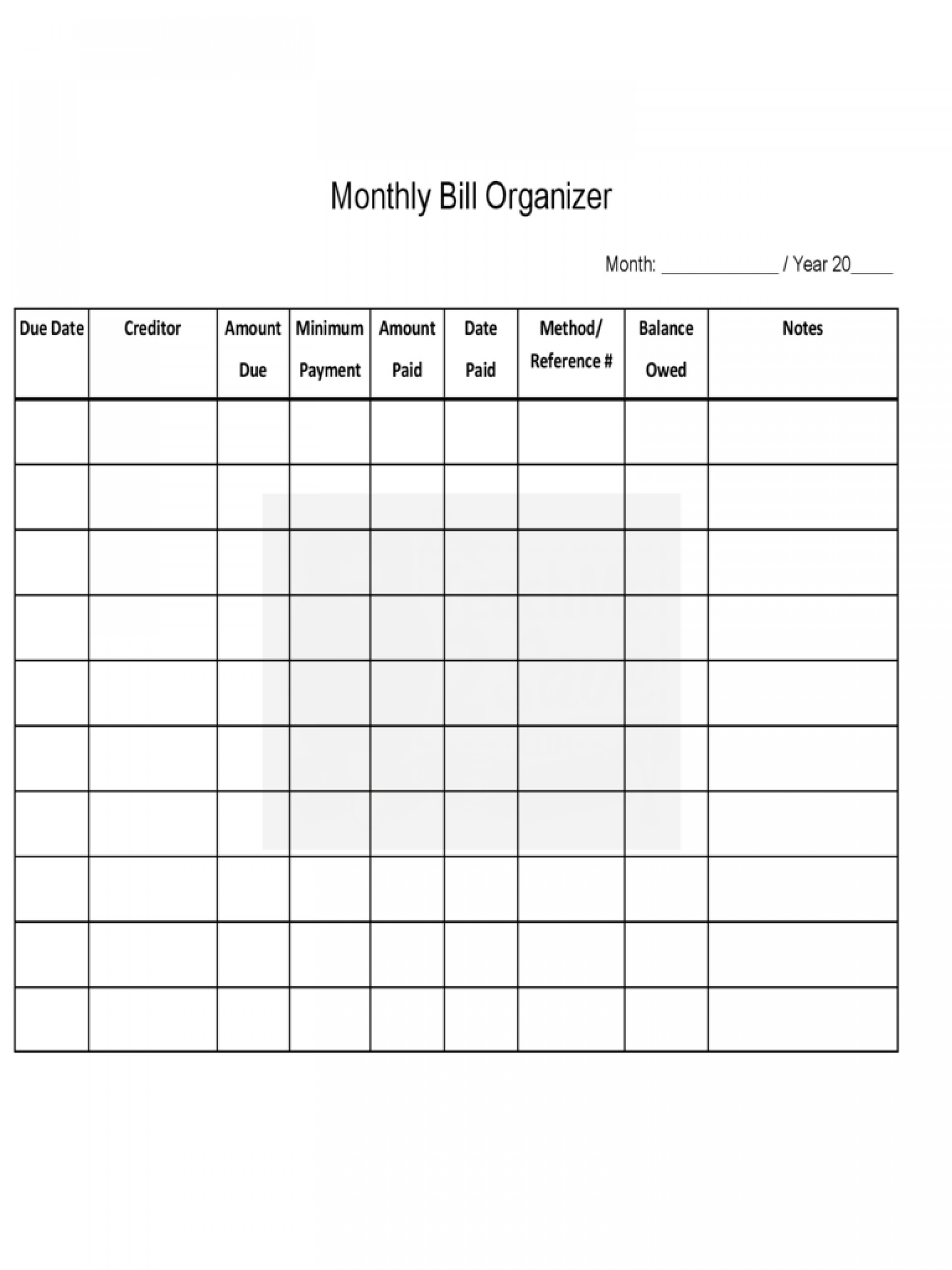

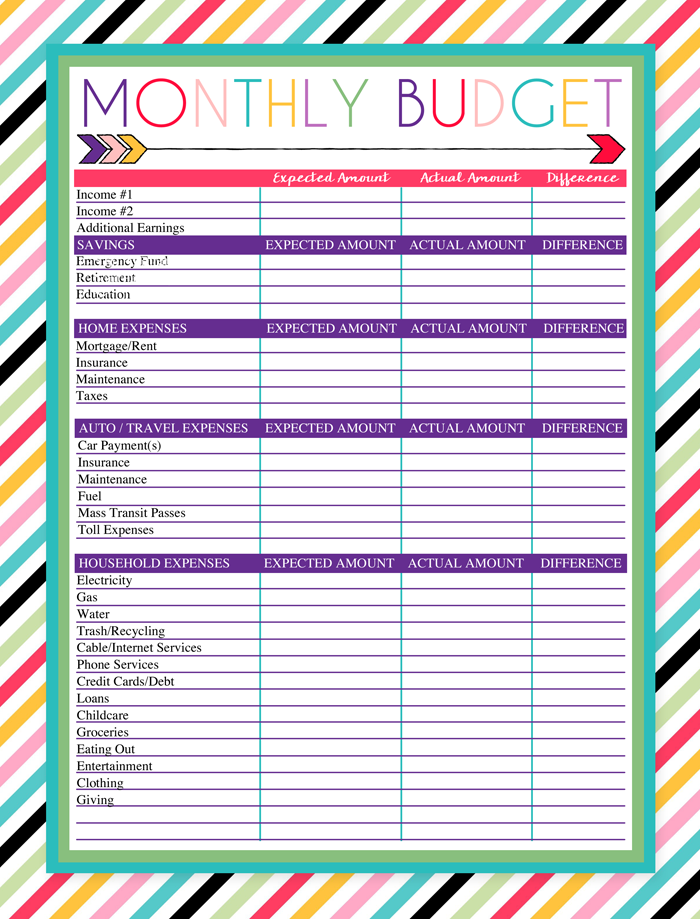

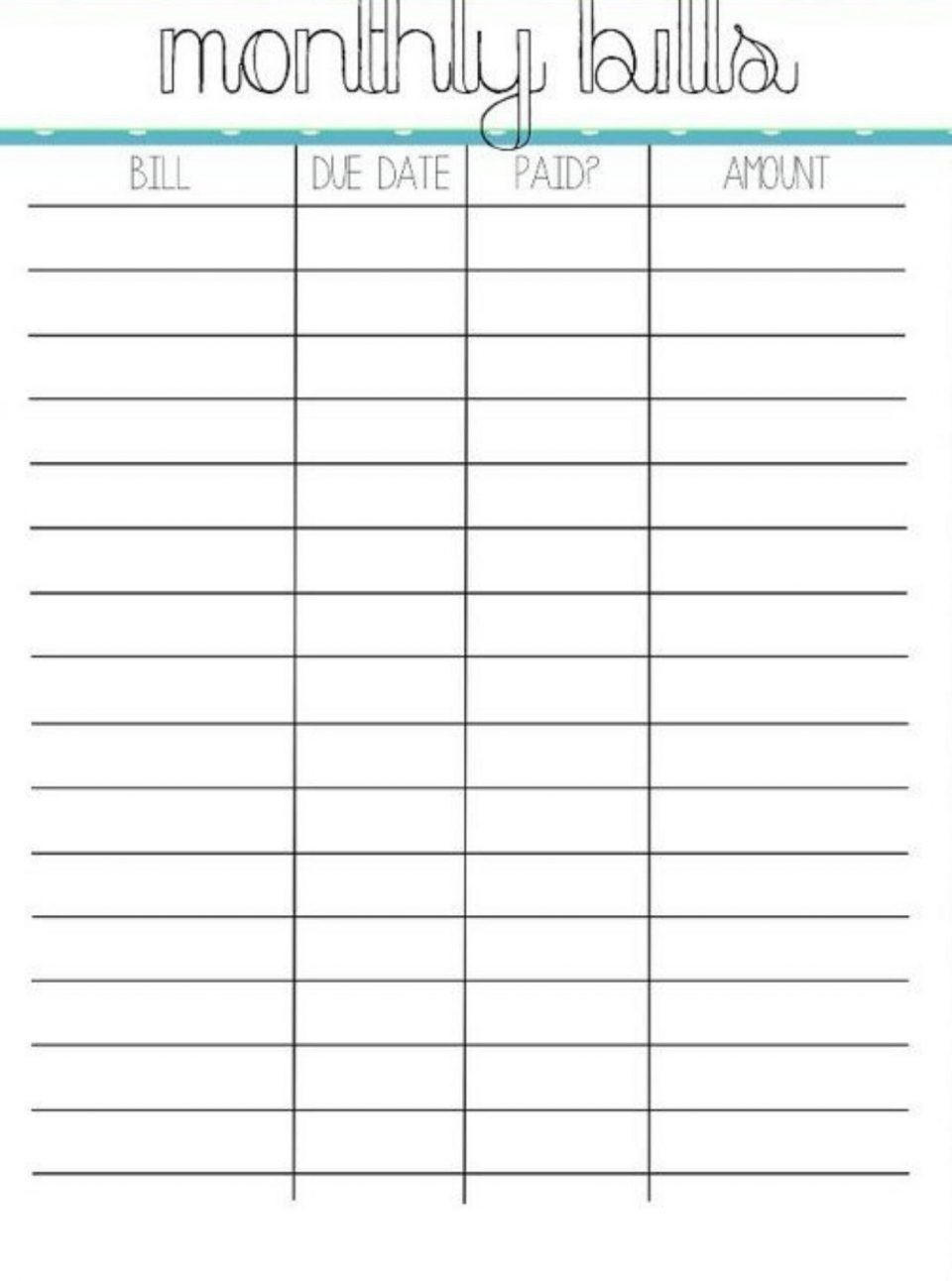

MONTHLY EXPENSES LIST PRINTABLE HOW TO

Over time, you’ll find out how to improve the budgeting process so that it better reflects your goals and priorities.The important thing is to track your spending and note where you deviated from your plan. You can use a notebook, a spreadsheet or a budgeting app.Saving for a large purchase like a home, car, education or starting a business.Establishing a savings or emergency fund.Use your priorities to set aside money.Include income from your spouse or partner and from full-time jobs, side hustles and other sources.List flexible and recurring expenses and debt payments.Start with budgeting living expenses like housing, food and transportation.These step-by-step instructions for how to create a budget will get you going: Steps To Create a Budget Everything else comes from the remaining 80%.īudgeting and forecasting isn’t always easy, but knowing the way to start can help. 80/20: You focus on setting aside 20% of your income for savings.Static budgeting: As the name indicates, a static budget stays the same even if your income increases.This allows more flexibility, but it takes more time to manage. Flexible budgeting: With a flexible budget, you reallocate your income and expenses as they change.Each spending category has an envelope, and once the money is gone, you stop spending. Envelope method: Popularized by Dave Ramsey, this method uses cash in envelopes to control spending.Every dollar that comes in has a function. Zero-based budgeting: With zero-based budgeting, you allocate all of your income so that your income minus your expenses equals zero.Elizabeth Warren, this budgeting method allocates 50% of your income to your needs, 30% to wants and 20% to building up savings and paying down debt.

When it comes to how to approach budgeting, there’s an option for everyone. 1.Poll: What Do You Think of Elon Musk Buying Twitter? Types of Budgeting Methods Hint: here's my guidance on how to fill out and use a budget sheet. Pick one of these cute printable monthly budget templates that you like, print it out, and get to budgeting.Īnd next week? Maybe try a different one on for size (go ahead, change up your budget worksheets like you change up your shoes!). Psst: after choosing one below? You'll want to check out my 14 stupid simple budgeting tips for beginners.Īlright – let's check out some cute budget worksheets. Once you find the kind that you love? Then you can spend some money upgrading (if you want to). That’s because the first one you try might not be the perfect one for you – you can try it out, then print out another one and try that on.

MONTHLY EXPENSES LIST PRINTABLE FREE

0 kommentar(er)

0 kommentar(er)